2020 is the “Year of the ADU”

There’s a new-old real estate investment that’s spreading like wildfire through communities across the United States: the accessory dwelling unit, or ADU for short. Homeowners around the country are expanding their investment by becoming a part of a much larger ADU lifecycle — more on that later.

On the surface, it’s an idea so simple it’s been applied in different forms for hundreds of years; from castle wings to traditional bed & breakfasts to in-house guest rooms, the idea of adding extra space to houses for guests or renters is relatively timeless. Especially in the days of extended family members all living under a single roof, the guest cottage was a necessary addition to houses around the world — that’s why it’s often called a “mother-in-law” apartment, after all.

While decreased land value and widespread municipal zoning restrictions forced ADUs out of favor in recent years, home additions of this nature are making a resurgence these days. Forbes even dubbed 2020 “the year of the ADU”.

There are two types of ADUs: the attached accessory dwelling unit (AADU) and the detached accessory dwelling unit (DADU). Both allow you a world of flexibility over the lifespan of your home.

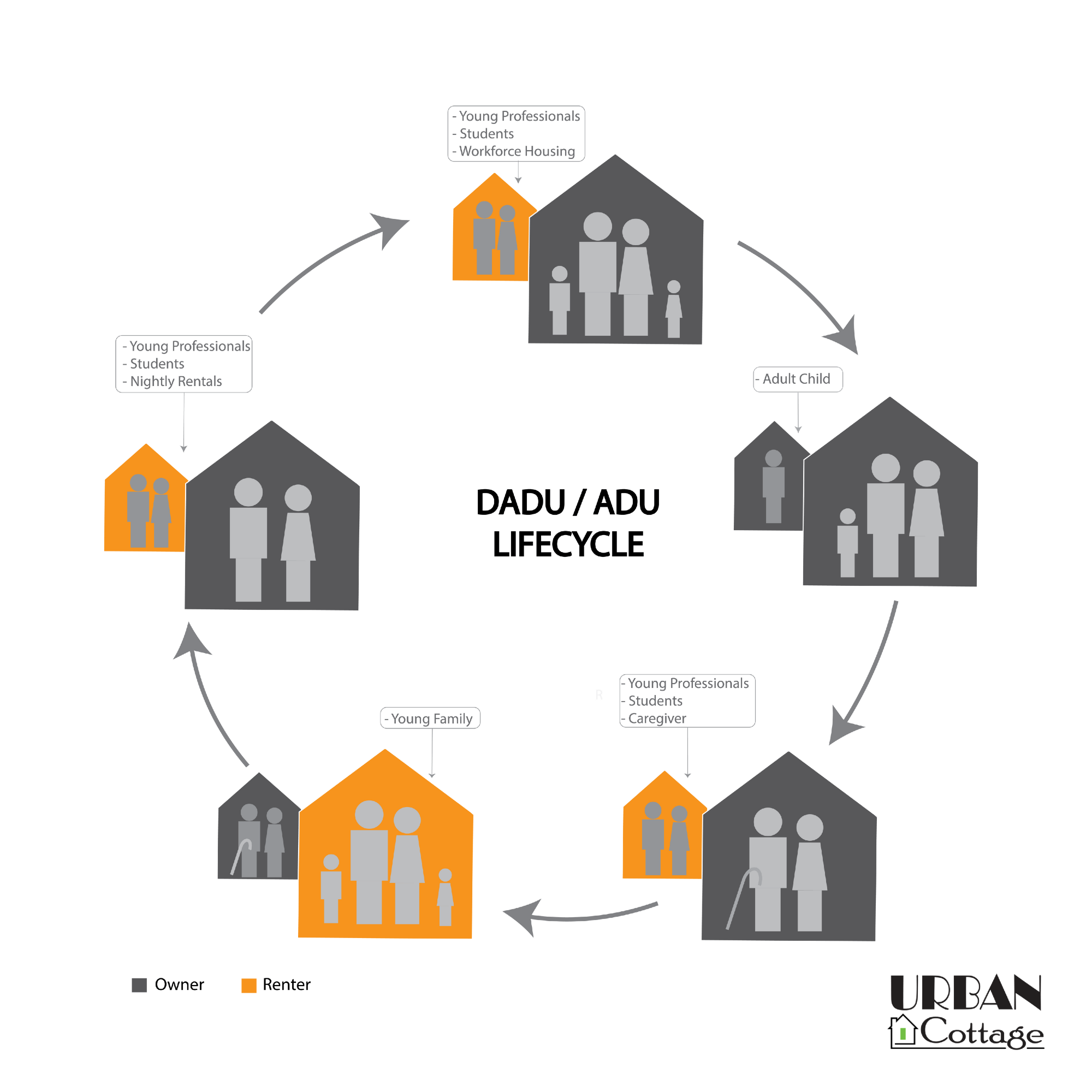

The above graphic details the ADU lifecycle, representing just some of the possibilities available to homeowners with ADUs on their property. In its essence, the ADU lifecycle is a concept that illustrates the various uses for an accessory dwelling unit (ADU) as the homeowner and members of the homeowner’s family age — from a young family renting the additional unit to a senior couple occupying the unit themselves, and all over again under new ownership. This process allows homeowners to age in place.

As shown, a homeowner could enter the cycle at any point around the circle.

Let’s say you enter the cycle at the left, as a couple. You can have the added income of renting on a nightly basis through online booking platforms like Airbnb. As you would imagine, nightly rental possibilities are almost completely location-dependent. But let’s just take a quick look at what might be possible:

Avg. Income from ADU

$ 125

Per NightAvg. Income from ADU

$ 375

Per WeekIf you only rent 3 nights/weekAvg. Income from ADUAnnually

$ 9,750

Per YearIf you rent only 6 months of the year (assuming seasonality)And, if you are located near a large venue or the city, that amount could double or triple!

As your family grows, you may feel more comfortable renting the space to more long-term tenants, like students or other young couples. Here’s what that might look like:

- Rent on an ongoing basis – assume 90% occupancy (you can almost never achieve 100% with renters moving in & out)

- And let’s assume a 300sf unit at $3.50/sf rent

12 mos x 0.9 x $10,500 = $11,340/year or about $950 per month.

Moving on into the adult child phase of life,

your “just getting started” offspring might use it for a couple years while they’re in college or launching their career. They might even stay into an early marriage — until they can afford to buy a separate place of their own.

While this scenario wouldn’t necessarily generate revenue, it does give parents of young adults the opportunity to help their children as they begin their independent, adult lives — and it gives the children a comfortable place to live while they’re trying to figure it all out. Plus, parents avoid having to help their children with rent elsewhere.

In the later, retirement phase of life,

you now have a way to stay in your house and neighborhood by helping to pay the bills with income from the unit. If needed, you might also have a caregiver live on site and help offset all or part of their rent by helping you!

After retirement,

you have the option to move into the ADU yourself, profiting post-retirement from tenants of the big house. Seniors often find comfy, smaller spaces easier to manage, maintain, and move about. Even stairs can become a chore later in life — the final stages of the ADU lifecycle take that into account. You get to stay in the neighborhood where you raised your kids, and enjoy the lifestyle you have come to appreciate and deserve, rather than moving into a high-density apartment complex or retirement home. Many cite this as the best part of aging in place.

Outside the ADU lifecycle, there’s also the opportunity to sell your DADU completely, condominiumizing your backyard and limiting liability as the unit’s landlord. While this might not be your initial goal, you reserve the right as property owner if it ends up making sense for you to separate yourself from the backyard cottage and profit from the one-time sale.

Applying the ADU Lifecycle

With Urban Cottage

All in all, there’s a reason 2020 was named the year of the ADU; as life continues to become more complex, adding a backyard cottage to your home offers a unique opportunity to simplify and enhance your living situation — no matter what phase of life you’re in.

At Urban Cottage, we can help you with any or all of the above. From buying or selling to designing and building, just give us a call.